How to get Vehicle Tax Clearance Certificate in Rajasthan?

How to get Vehicle Tax Clearance Certificate from RTO in Rajasthan?

There is no need for Vehicle owners to visit the transport office for ‘tax paid certificate’ (TPC) of vehicles as it can be easily obtained online by visiting the transport department’s portal. Those who wish to avail this facility can visit the official transport website 'Parivahan' and selecting the ‘tax clearance certificate’ service option. Though it is applicable for every vehicle owner, but it would be particularly useful for commercial vehicle owners who need to pay tax every year.

Transport commissioner Mahendra Soni said, “As many vehicle owners are techno-friendly, they can now get TPC by applying online from home, office or be it any other place. The procedure to apply online for the Tax Paid Certificate will definitely save endless time in commuting to offices. One can also get this facility by visiting their nearest transport office. This will result in bringing more transparency in the work of the department.”

To get the online Tax Paid Certificate, the applicant needs to go the transport department portal and apply for the certificate as well as select the RTO along with DTO. After this the registration, chassis and engine number of the vehicle needs to be filled in. After submitting the details, all information related to the vehicle will be displayed on the screen. One can also see the history of TPC in which if there is any kind of dues, a message will be sent to the owner’s mobile number to deposit it. In case of non-payment of dues, TPC will be approved by the transport officer through e-sign. Applicant can then take a printout for their use.

Vehicle Tax RTO Clearance Certificate

These are the steps in order to get Vehicle Tax Paid Certificate / Vehicle Tax Clearance Certificate (TPC) of Vehicle in Rajasthan:

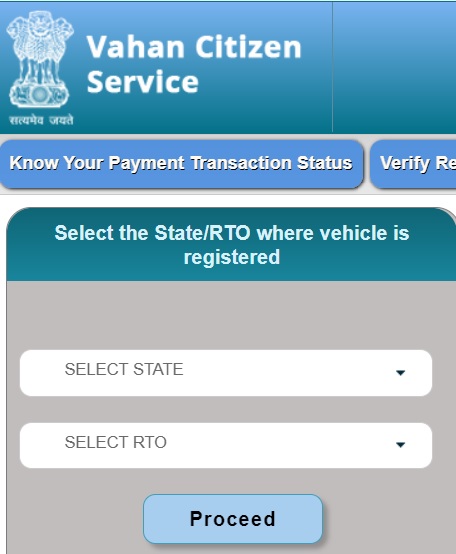

- Visit this url in browser : https://vahan.parivahan.gov.in/vahanservice/vahan/ui/statevalidation/homepage.xhtml

- Select the State/RTO where vehicle is registered

- Select State as Rajasthan

- Select your RTO

- Click Proceed

- Hover your mouse on Services link at the top and then Apply for Certificates and then Tax Clearance Certificate.

- Tax Clearance Certificate page opens

- Enter Vehicle Registration Number, Chassis No. (Full) and Engine Number

- Click Validate and follow the steps further to get Tax Clearance Certicate.

Tax Paid Certificate (TPC) is important because in case of non-payment of tax, a fine of Rs 500 and the outstanding tax amount is levied. As we have told you about how to apply for online TPC facility, the vehicle owner can easily maintain it as a proof of deposit of tax.