How to Download E PAN Card Online?

How to Download E PAN Card Online?

A Permanent Account Number or PAN card is one of the important financial identity proof of a person. PAN card helps a person in filing his/her income tax return and it also facilitates KYC. In today's time, one cannot imagine opening a bank account without a PAN card or getting a debit or credit card or do money transactions after a certain limit.

There are some cases and situations when the PAN card is misplaced or your PAN card is lost, then in these tough times it becomes of utmost importance to inform first of all the Income Tax department about it and then just writing in the Lost/Found messages to Police for the loss of PAN Card. Income tax department provides an online facility of e-PAN by which you can instantly download a digital version of your PAN card, which is fully valid proof in all the places you require PAN. You don't need to remember your PAN number for the download to work, instead it just uses your Aadhar number.

How to Download E PAN Card Online?

The following information reveals how to download E PAN Card from Income Tax Site or how to download E PAN Card without PAN Number with Aadhaar card number only.

The e-PAN card download facility is available from the official website of the Income Tax Department by following a few simple steps:

- Visit the official website of Income Tax e-Filing - https://www.incometax.gov.in/

- Scroll down below to find “Our Services” section and look for Instant E-PAN(apply for new PAN/update) located just below “Know TAN…”

- This is the direct link to apply and download e PAN Card - https://eportal.incometax.gov.in/iec/foservices/#/pre-login/instant-e-pan

- e-PAN page opens.

- If you have never downloaded e-PAN before, click on Get New e-PAN under the “Get New e-PAN section”. If you have downloaded e-PAN before, click under the “Check Status/Download PAN” section, click on Continue.

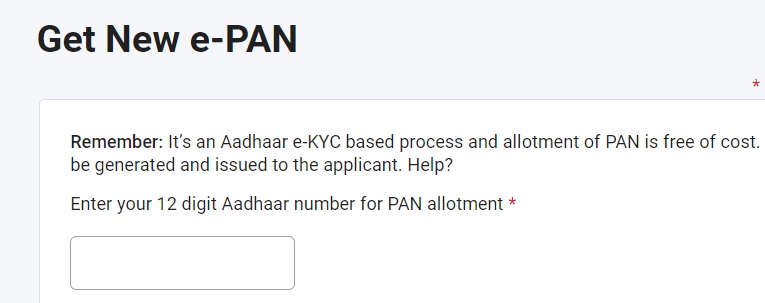

- Get New e-PAN page opens.

- Now, enter your Aadhaar number. Enter your 12-digit Aadhaar number for PAN allotment in the space provided.

- Tick the box I confirm. Read carefully the declaration which is as follows:

- I have never been allotted a Permanent Account Number (PAN)

- My active mobile number is linked with Aadhaar

- My complete date of birth (DD-MM-YYYY) is available on Aadhaar card

- I am not minor as on application date of Permanent Account Number (PAN)

- Click on Continue.

- You will get an OTP on your Aadhaar-linked mobile number. Enter the OTP in the given space.

- Check your information carefully, and enter your email address in the given space and click on confirm button.

- You will receive e-PAN in your email inbox within minutes. Check your inbox and download PAN in pdf format and take a print out if you desire. This was the full process on how to download e pan card online

If you have your PAN number with you and for some reason, you are not able to download e-PAN using the above method, you can also download it from the TIN-NSDL website or UTIITSL websites based on where your original PAN card was generated.