EPF Withdrawal Online Process, How to Withdraw EPF - All Steps you Need to Know

EPF withdrawal upon premature death of a family member: All Steps you need to know

The Employee Provident Fund is after retirement benefits scheme in which employees of an organization contribute a small proportion of their basic salary and an interest rate is given every year. This provident fund amount is used after retirement or in some cases before retirement. They benefited every year with a certain interest rate.

Employee and Employer pay an equal amount of their salary towards the EPF scheme. The total of this amount is then deposited in the Employee Provident Fund Organisation(EPFO).

EPF serves the purpose of salary and dearness allowance. EPF is a combination of three different schemes as after EPF registration, you automatically get yourself register for EPS and ELDI. There are certain situations when you need to withdraw EPF before retirement so below we have given the steps you need to do in order to withdraw money from EPF account.

EPF Withdrawal Process - Steps to withdraw EPF

In case of a member's unfortunate death before the age of retirement, the family gets insurance of up to 7 lakhs under the EDLI scheme and monthly widow/child/orphan pension under the EPS scheme. The family, minor or lunatic member can also claim provident fund withdrawal using EPF form 20. If there is no nominee registered, then the legal heir can claim the provident fund amount.

All the required documents along with the completed form must be submitted to the regional EPF commissioner’s office for further processing.

How to Withdraw EPF Online?

- Visit EPFO India Official website - Employees' Provident Fund Organisation (epfindia.gov.in)

- Under Services link at the top, Click on the link, "For Employees"

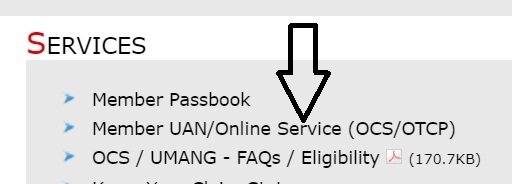

- On the Employees Page, Click on "Member UAN/Online Service (OCS/OTCP)" link under Services.

- On the Employees Provident Fund member page, click on the link "Death claim filing by beneficiary" at the right bottom of the page.

- On the next screen that appears, enter the details like UAN and beneficiary details like Name, Aadhaar Number, Date of Birth and enter captcha code. Click Authorization Pin.

- You will receive a PIN Number on the mobile number registered. Thus you can follow the instructions.

- UAN of member

- Beneficiary's Aadhaar, Name, Date of birth as declared by member during filing of e-nomination

- Bank account number and correspondence

- Death Certificate of member

- Bank account proof [Cancelled cheque / Passbook] of beneficiary

- Date of Birth proof of beneficiary

- Only PDF file will be allowed

- Size of the uploaded file should not be greater than 2 MB

Steps to fill in EPF FORM NO-20

Particular of the member

Name of the Member

Father’s/Husband’s Name (in case of married women)

Name & Address of the Factory/ Establishment in which the member was last employed

EPF Account Number

Date of Leaving the Service

Reason for Leaving the Service (Mention “Death” in case of the deceased member)

Date of Death (dd/mm/yyyy)

Marital status of the member on the day of his/her death

Particulars of the Claimant

Name of the Claimant

Father’s/Husband’s Name

Gender

Age (as on the date of death of the member)

Marital Status (As on the date of death of the member)

Relationship with the deceased member

Section to be filled by the Guardian/Manager of Minor/Lunatic Member

or

Guardian of Lunatic/Minor Nominee(s)/Legal Heir (s)/Family member (s) of the Deceased Member

Name of the Claimant

Father’s/Husband’s Name

Relationship with the minor/deceased member

Claimant’s Full Postal Address (in block letters)

Mode of Remittance

By Postal Money Order

By account payees, cheque/ electronic mode sent Direct for credit to my S.B. A/C (Scheduled Bank/PO)

Please attach a copy of the cancelled / blank Cheque)

Important Documents Needed by the claimants for EPF Withdrawl

- Aadhar Linked mobile number to get SMS alerts at different stages of approval

- Details in block letters in the form

- Cancelled cheque of the bank account to get the amount disbursed in your bank account

- The address should be complete and contain the PIN Code.

- EPF Form 5 IF, EPF Form 10D, EPF Form 10C, EPF Form 20

The EPF Form 20 can be filled by the following claimants:

- By the guardian of a minor/lunatic member

- By a nominee or legal heir of the deceased member

- By the guardian of the minor/lunatic nominee or heir for claiming the Provident Fund accumulation of the minor deceased member

The claimant has to submit Form 20 (for EPF withdrawal claim) as well as Form 10C/D to claim all the benefits under the three schemes; EPF, EPS, and EDLI). EPF Form 20 must be forwarded to the EPFO through the employer under whom the member was last employed. The employer, as well as the claimant, needs to sign each and every page of the form. The form has to be duly verified and attested online or offline.

After all the documents are provided and the claim is accepted, the EPF commissioner must settle the claim within 30 days from the receipt of the claim. EDLI scheme provides financial security to the family members of the deceased person.

Now, e-nominations are also provided for filing nomination forms. This was a complete process on how to withdraw EPF online.